Last Updated: November 2, 2025

GILBERT INVESTMENT RESEARCH

WALKER RIVER RESOURCES INDEPENDENT TECHNICAL ANALYSIS

Why Does Walker River Resources Trade at $16/oz When Comparable Northern Superior Was Acquired for $125/oz?

FULL ANALYSIS & SUPPORTING DOCUMENTATIONThree detailed reports examine the valuation gap using comparable transaction analysis, DCF methodology, and drilling results:

KEY INVESTMENT THESIS

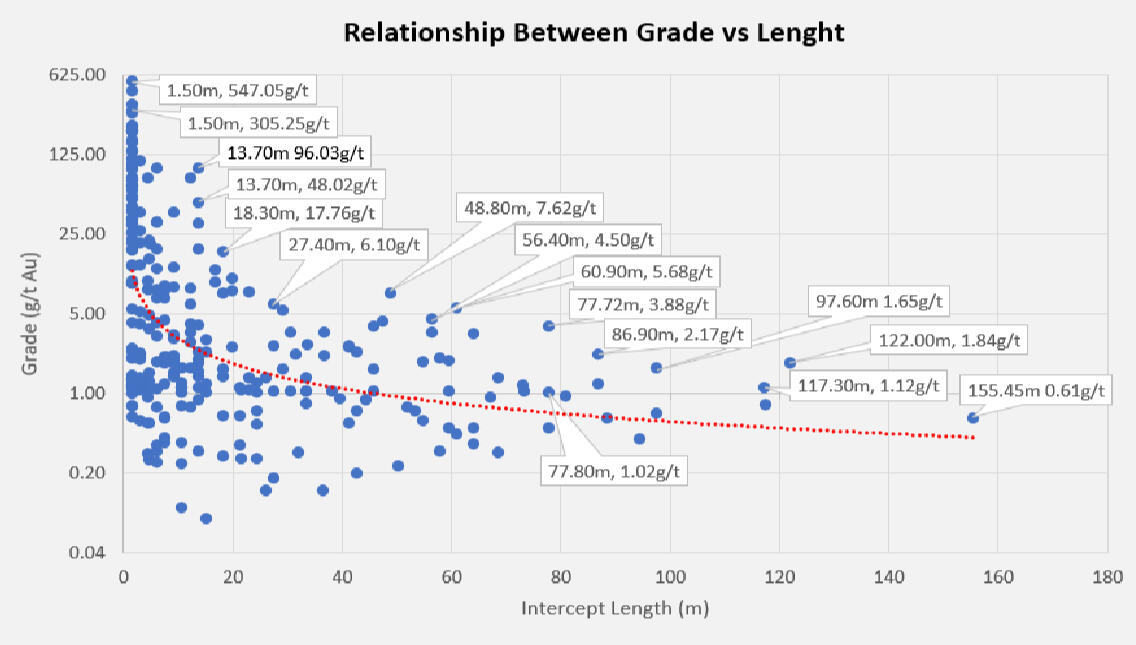

This independent analysis examines Walker River Resources' Lapon Canyon Project in Nevada. Using comparable transaction analysis and DCF methodology, I've identified a significant valuation gap between WRR's current $16/oz market valuation and the $125/oz paid for comparable Northern Superior Resources.Key highlights include ultra-high-grade intercepts (547 g/t Au over 1.5m), substantial bulk tonnage potential (155m at 0.61 g/t Au), and Nevada's tier-1 mining jurisdiction advantages.

EXCEPTIONAL DRILLING RESULTS

Tier-1 High-Grade Combined with Significant Width

547 g/t Au over 1.5m - Peak ultra-high-grade discovery (LC 19-42)

96.00 g/t Au over 13.7m - High-grade over significant width (LC 19-42)

77.62 g/t Au over 12.2m - Hotspot Zone historical intercept (LC 16-10)

3.88 g/t Au over 77.7m - Exceptional bulk tonnage with grade (LC 24-117)

155m at 0.61 g/t Au - Largest bulk tonnage intercept to date (LC 24-114)

ADDITIONAL RESOURCES & VIDEOS

Walker River Resources Corporation

Stock Ticker: TSXV: WRR

Official Website: Walker River Resources www.wrrgold.comCompany Videos:

Lapon Canyon Project Overview: Watch VideoThe Hot Spot - Lapon Canyon: Watch Video

ABOUT THE ANALYST

I'm Alain Gilbert, B.Eng., a mechanical engineer who applies systematic analytical methods to identify undervalued opportunities in the resource sector. After discovering Walker River Resources during my research into Nevada gold opportunities, I was struck by the significant valuation gap between WRR and recent comparable transactions.This analysis began as personal due diligence for my own investment decision. After building detailed comparable analyses and DCF models, I realized the findings were too compelling not to share with other investors interested in undervalued Nevada gold opportunities.This analysis was conducted independently using publicly available data and industry-standard methodologies. All sources are cited and calculations are transparent and defensible.

Contact

Questions about the analysis?

Want to discuss the methodology or findings?I welcome feedback from fellow investors and mining professionals.Alain Gilbert, B.Eng.

Independent Mining Analyst

Email me at: [email protected]

DISCLAIMER: This is not investment advice. I am not a financial advisor. All information is for educational purposes only. Conduct your own due diligence before making any investment decisions.